Welcome to the ultimate guide to credit cards! In today's fast-paced world, managing finances effectively is crucial, especially in a vibrant city like Nagpur. Whether you're a seasoned professional or a college student embarking on your financial journey, understanding the ins and outs of credit cards can be a game-changer. In this comprehensive guide, we'll delve into everything you need to know about credit cards and how they can empower you financially.

1. What is a Credit Card?

A credit card is a powerful financial tool that allows you to make purchases on credit, up to a predetermined limit. Unlike debit cards, which deduct funds directly from your bank account, credit cards enable you to borrow money from the card issuer and repay it later, usually on a monthly basis. This flexibility makes credit cards invaluable for managing day-to-day expenses, unexpected emergencies, and even larger purchases like home appliances or travel bookings.

2. Unveiling the Power of Credit Cards:

- Beyond Transactions: A credit card is more than just a payment tool. It offers flexible credit, allowing you to manage everyday expenses, cover emergencies, or finance larger purchases like appliances or travel.

- Unlocking Perks: Earn rewards points, miles, or cashback on your spending, redeemable for travel, shopping, dining, or statement credits, maximizing your financial gain.

- Building Credit Muscle: Responsible credit card use helps build a healthy credit score, essential for securing loans, mortgages, and better interest rates in the future.

3. How is the Credit Card Limit Calculated? Understanding Your Credit Limit:

The credit card limit, or the maximum amount you can spend on your card, is determined by several factors including the following factors -

- Factors at Play: Your credit limit depends on your income, credit score, employment status, existing debts, and spending habits. Maintaining a good credit score is key to a higher limit.

- Building Trustworthiness: Lenders assess your creditworthiness based on payment history, credit utilization ratio, credit history length, and credit account types. Regular, on-time payments and responsible spending build trust.

4. How Do Credit Cards Work?

Credit cards allow you to borrow funds up to a certain limit to pay for goods and services. Each month, you receive a statement detailing your purchases, and you’re required to pay at least a minimum amount by a due date. Interest is charged on any unpaid balance, so it’s wise to pay off the full balance each month to avoid fees and debt.

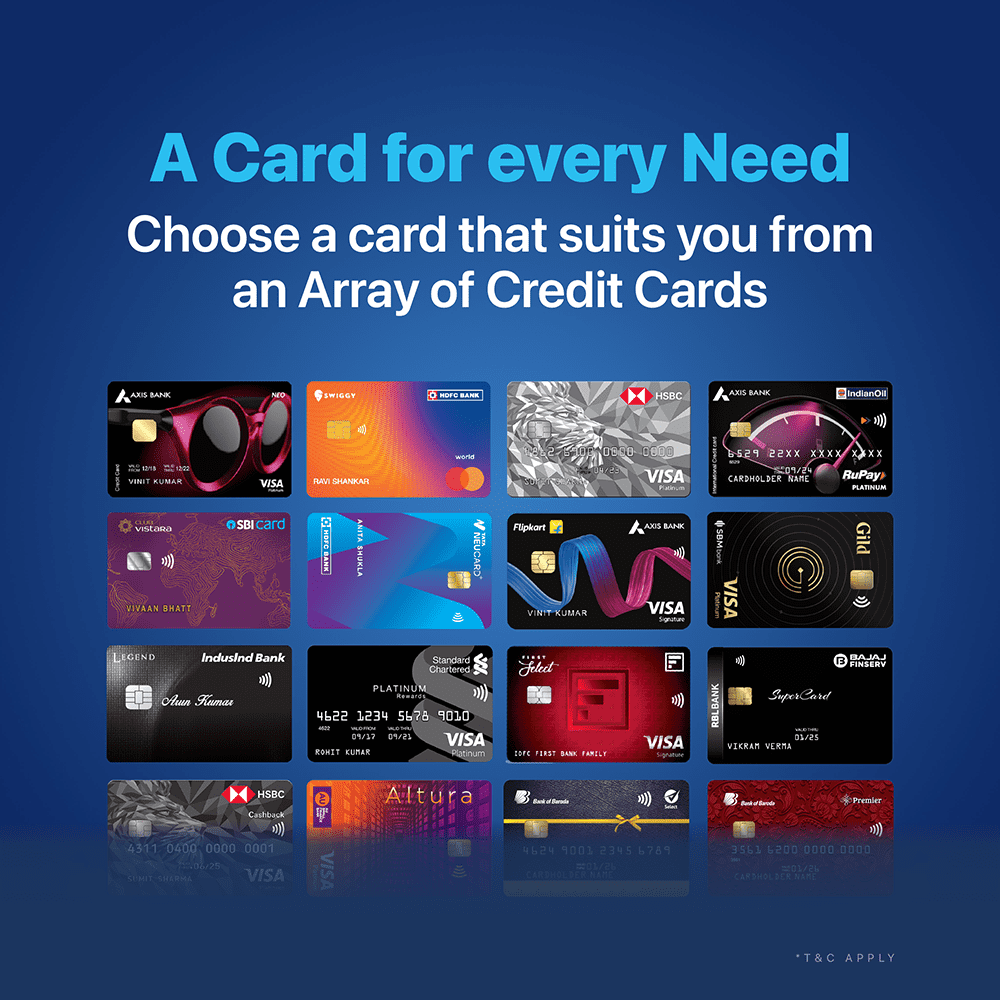

5. Types of Credit Cards: Finding Your Perfect Match:

Diverse credit card offerings cater to various lifestyles and needs:

- Rewards Credit Cards: Earn travel miles, cashback, or points for everyday purchases, ideal for maximizing rewards.

- Travel Credit Cards: Enjoy airport lounge access, travel insurance, and travel discounts for the frequent flyer.

- Cashback Credit Cards: Get instant savings on everyday purchases with a percentage of your spending returned as cash.

- Student Credit Cards: Designed for responsible young adults building credit, often with lower limits and educational resources.

6. Beyond Convenience: The Benefits of using Credit Card:

- Convenience: Enjoy the ease and convenience of cashless transactions, both online and offline, saving time and hassle.

- Build Credit History: Responsible use of credit cards can help establish and improve your credit score, which is essential for accessing future credit, loans, or mortgages.

- Fraud Protection: Most credit cards offer robust security features and fraud protection measures, minimizing your liability for unauthorized transactions.

- Rewards and Perks: Take advantage of rewards programs, cashback offers, and exclusive discounts to maximize your savings on everyday purchases.

- Budgeting Ally: Track your spending through detailed statements, helping you manage your budget effectively.

- Emergency Credit: Credit cards provide a valuable line of credit in emergencies when immediate funds are needed.

7. Responsible Use: The Key to Success:

- Start Smart: Before diving in, ensure a stable income, understand budgeting, and prioritize timely payments to avoid debt.

- Know Your Limits: Don't overspend beyond your repayment capacity. Track your spending and stay within your limit.

- Avoid Cash Advances: These come with high fees and interest rates, making them expensive ways to access cash.

8. Here are some responsible strategies to improve your credit score using a credit card:

- Make on-time payments: This is the single most important factor influencing your score. Late payments can significantly damage it.

- Maintain a low credit utilization ratio: This means keeping your balance well below your credit limit. Ideally, aim for below 30%.

- Avoid unnecessary inquiries: Applying for numerous credit cards in a short period can negatively impact your score.

- Consider authorized user status: Adding yourself as an authorized user on someone else's account with good credit history can help, but use it responsibly.

- Dispute errors on your credit report: Ensure your report is accurate and free of errors that could be lowering your score.

9. Strategies to avoid for rapid improvement:

- Maxing out your credit limit: This significantly increases your utilization ratio and hurts your score.

- Carrying a balance month-to-month: Interest charges and high balances damage your score.

- Balance transfers: These can be helpful for consolidating debt, but only if managed responsibly.

- Closing unused accounts: Older accounts positively impact your score, so closing them might not be helpful.

10. Here are some additional responsible suggestions that can contribute to a positive credit history:

- Utilize secured credit cards: If you have limited credit history or a past misstep, consider a secured credit card. You deposit a security deposit that becomes your credit limit, building positive credit history with responsible use.

- Set up autopay: Setting up automatic payments ensures you never miss a payment, eliminating the impact of late payments on your score.

- Leverage credit monitoring: Free credit monitoring services can alert you to potential errors on your credit report, allowing you to dispute them quickly and maintain accuracy.

- Consider becoming an authorized user: If a close family member with good credit history is willing, becoming an authorized user on their account can positively impact your score (though manage responsibly).

- Negotiate credit limits: If you have a good credit history and responsible usage, consider contacting your credit card issuer to request a higher credit limit, improving your utilization ratio.

- Avoid quick fixes: Tactics like carrying a small balance every month or opening and closing multiple accounts can have unintended consequences.

- Stay informed: Read up on responsible credit card usage and understand the factors influencing your score.

- Monitor progress: Regularly check your credit report and score to track progress and address any issues promptly.

11. Is a Credit Card Good or Bad?

The answer to whether a credit card is good or bad largely depends on how you use it. When used responsibly, credit cards can be an excellent financial tool, offering convenience, rewards, and credit-building opportunities. However, if used recklessly, such as making late payments or overspending, credit cards can lead to debt and financial stress. The key is to manage your spending and always pay your bills on time.

12. Can You Withdraw Money from a Credit Card?

Yes, you can withdraw money from a credit card through a process called a cash advance. However, it's important to note that cash advances usually come with higher interest rates and fees compared to regular purchases. In Nagpur, ATMs from major banks typically allow for credit card cash advances, but it’s best to use this option only in emergencies due to the associated costs.

13. Which is Better: Credit or Debit Card?

Both credit and debit cards have their advantages, and the choice between the two depends on your financial habits and needs. Credit cards offer more benefits, such as rewards, fraud protection, and the ability to build credit, while debit cards draw directly from your bank account, helping you avoid debt. In Nagpur, having both cards can provide flexibility; use a credit card for major purchases and rewards, and a debit card for everyday expenses to manage your budget effectively.

Remember, credit cards are financial tools, and misuse can lead to debt and negative consequences. It's crucial to prioritize responsible usage and long-term financial health over the desire for a rapid score increase.

Conclusion:

Credit cards, when used wisely, can empower your financial journey . By understanding their features, choosing the right card, and practicing responsible spending, you can unlock a world of convenience, rewards, and financial security. Remember, financial planning is crucial.

If you have questions or need guidance, just click here.

Choose your own credit card by filling out this simple form: